Corvus Gold Extends Strike Length of West Vein Zone of the Yellowjacket Deposit at North Bullfrog Project, Nevada

May 1, 2014

|

NB-14-384

|

14 metres @ 6 g/t Gold and 72 g/t Silver

|

|

NB-14-380

|

Lower Vein: 13 metres @ 5.6 g/t Gold and 94 g/t Silver &

Upper Vein 17 metres @ 1.2 g/t Gold and 38 g/t Silver |

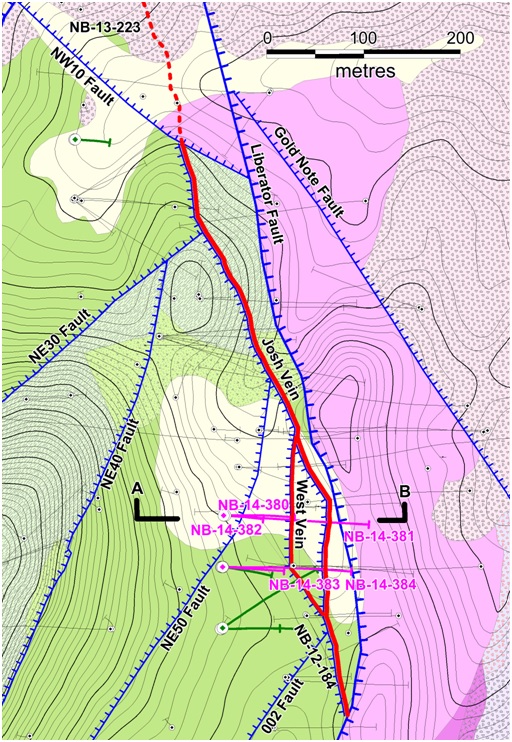

Vancouver, B.C… Corvus Gold Inc. (“Corvus” or the “Company”) - (TSX: KOR, OTCQX: CORVF) announces new results from its ongoing 2014 Phase One drill campaign at the North Bullfrog Project in Nevada. Assay results include the full intercept of the previously reported hole NB-14-380 as well as four recently completed holes from the new West Vein zone (Figure 1, Table 1). Hole NB-14-384 intersected 4.5 metres of 17 g/t gold and 140 g/t silver in the West Vein structure, 50 metres along strike from NB-14-380 (5 metres at 14 g/t gold) while NB-14-382 encountered 4.7 metres of 4.6 g/t gold and 0.5 metres of 181 g/t gold, 25 metres down dip from NB-14-380.

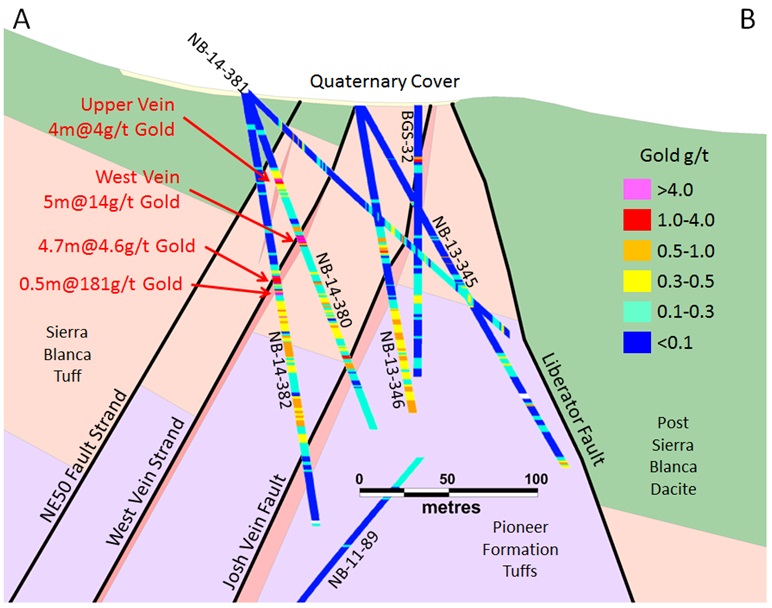

Full assay results have now been received from hole NB-14-380 (initially reported in NR-14-09, March 13, 2014). Results from the stockwork vein zone around the Upper Vein returned an overall intercept of 17 metres @ 1.2 g/t gold and 38 g/t silver (Table 1, Figure 2). The stockwork around the lower main West Vein in this hole has returned an intercept of 13 metres of 5.6 g/t gold and 94 g/t silver (Table 1). Mineralization in the Josh Vein structure in this hole is confined to the hangingwall zone (Table 1, Figure 2). NB-14-381 was drilled above NB-14-380 and intersected the West Vein at a shallow depth above the productive mineralized zone and drilled on into the hangingwall of the Josh Vein at depth (Table 1, Figure 2). NB-14-382 was drilled below NB-14-380 on the same section and encountered 4.7 metres of 4.6 g/t gold and 34 g/t silver in the main vein and several mineralized veins in the footwall, including a 0.5 metre interval with 181g/t gold and 94 g/t silver (Table 1, Figure 2).

Stepping 50 metres to the south of the previous three holes, hole NB-14-383 encountered 4.7 metres of quartz vein that was modestly mineralized, however, the total stockwork zone gave an intercept of 42 metres with 0.5 g/t gold and 3 g/t silver (Figure 1, Table 1). Hole NB-14-384 (drilled 50 metres up-dip from NB-14-383) encountered 14 metres of quartz veining with an average grade of 6 g/t gold and 72 g/t silver which includes a high-grade interval with 4.5 metres of 17 g/t gold and 140 g/t silver. The assays for the remainder of NB-14-384 are pending.

An additional five holes have now been completed in the West Vein target with results pending. The West Vein zone has now been tracked for 125 metres along strike and to a down dip depth of nearly 150 metres. The West Vein system appears to merge with the Josh Vein to the south near drill hole NB-12-184 (Figure 1). The drill has now been moved to the north to continue delineating the northern extent of the Yellowjacket Deposit’s main Josh Vein system and will eventually return to the West & Josh Vein area to continue exploring the system to the south and at depth.

Table 1: Significant Intercepts* from 2014 Drilling at Yellowjacket

(Reported drill intercepts are not true widths. At this time, there is insufficient data with respect to the shape of the mineralization to calculate its true orientation in space.)

|

HoleID

|

From

(m) |

To

(m) |

Interval

(m) |

Gold

(g/t) |

Silver

(g/t) |

Comments

|

|

NB-14-380

Az 90; Incl -70 |

46.3

|

51.4

|

5.1

|

0.43

|

4.9

|

UV HW Stockwork

|

|

51.4

|

54.9

|

3.6

|

4.19

|

150

|

Upper Vein

|

|

|

54.9

|

63.0

|

8.0

|

0.31

|

10.0

|

UV FW Stockwork

|

|

|

16.7

|

1.18

|

38

|

Upper Vein + Stockwork

|

|||

|

80.0

|

85.3

|

5.3

|

0.41

|

2.8

|

WV HW Stockwork

|

|

|

85.3

|

90.0

|

4.8

|

13.81

|

243

|

West Vein

|

|

|

90.0

|

92.7

|

2.7

|

1.04

|

4.8

|

WV FW Stockwork

|

|

|

12.7

|

5.57

|

94

|

West Vein + Stockwork

|

|||

|

113.2

|

114.9

|

1.7

|

0.88

|

1.9

|

|

|

|

120.2

|

157.4

|

37.2

|

0.34

|

1.0

|

JV HW Periph

|

|

|

157.4

|

165.6

|

8.2

|

0.70

|

1.1

|

JV HW Stockwork

|

|

|

NB-14-381

Az 90; Incl -45 |

108.1

|

113.9

|

5.9

|

0.29

|

4.4

|

Josh HW Periph

|

|

119.1

|

122.8

|

3.7

|

0.51

|

10.0

|

Josh HW Stockwork

|

|

|

NB-14-382

Az 90; Incl -80 Including |

97.5

|

104.0

|

6.5

|

0.25

|

1.4

|

West Vein HW Stockwork

|

|

104.0

|

108.7

|

4.7

|

4.62

|

34

|

West Vein

|

|

|

108.7

|

116.1

|

7.4

|

1.05

|

1.5

|

WV FWStockwork

|

|

|

18.6

|

1.67

|

9.6

|

West Vein + Stockwork

|

|||

|

116.1

|

159.1

|

43.0

|

2.56

|

2.3

|

WV FW Periph

|

|

|

127.2

|

127.7

|

0.5

|

181.50

|

94

|

Single vein

|

|

|

167.7

|

170.5

|

2.7

|

0.11

|

142

|

High Silver Fault Gouge

|

|

|

172.5

|

199.1

|

26.6

|

0.50

|

1.1

|

Josh HW Stockwork

|

|

|

NB-14-383

Az 90; Incl -80 |

138.1

|

150.3

|

12.2

|

0.52

|

1.6

|

WV HW Periph

|

|

150.3

|

160.1

|

9.9

|

0.86

|

8.0

|

WV HW Stockwork

|

|

|

160.1

|

164.9

|

4.7

|

0.40

|

4.0

|

West Vein

|

|

|

164.9

|

192.5

|

27.6

|

0.40

|

1.6

|

WV FW Stockwork

|

|

|

42.2

|

0.52

|

3.4

|

West Vein + Stockwork

|

|||

|

NB-14-384

Including Az 90; Incl -55 |

114.4

|

128.4

|

14.0

|

6.04

|

72

|

West Vein

|

|

114.4

|

118.9

|

4.5

|

16.96

|

140

|

|

|

|

|

|

|

|

|

|

*The veining and stockwork veining have been defined by geological observation of the percentage of veining in the interval, e.g. significant concentrations of veining in the immediate hangingwall and footwall of a significant vein. Outside of the immediate hangingwall and footwall zones a cutoff of 0.3 g/t gold equivalent has been used assuming a 1:55 price ratio of gold to silver. Up to 3 metres of internal waste has been carried locally.

Yellowjacket Vein Zone Exploration

The Yellowjacket Vein Zone at North Bullfrog is currently defined by the Josh-West Vein structural zone on the west and the Liberator Fault to the east (Figure 1). The interaction of these two faults has created a large broken zone which contains several quartz veined structures, such as the Josh Vein, and broad zones of stockwork mineralization. The West Vein strand delineated by 2014 drilling represents a new hangingwall splay off the main Josh Vein Fault that contains gold and silver mineralization to the main Josh Vein.

Drilling now indicates that large northeast faults such as the NE30 and NE50 faults (Figure 1) do not cut off the Josh Vein Fault system but enhance it as a host for vein development and have emerged as new exploration targets (Figure 2).

The 5,000 metre Phase One drilling program at North Bullfrog will continue to focus on delineating the Yellowjacket system. In the planned 15,000 metre Phase Two program, additional core rigs will be added to conduct resource definition drilling and continue with the District-wide exploration for other vein systems.

Figure 1: Location of 2014 drill holes at Yellowjacket. Assays from the holes indicated in fuscia are reported in this release. Green traces are from holes with pending assays. The location of the section in Figure 2 is indicated.

Figure 2: Geological Cross Section through holes NB-13-380, 381 and 382 reported here.

About the North Bullfrog Project, Nevada

Corvus controls 100% of its North Bullfrog Project, which covers approximately 68 km² in southern Nevada. The property package is made up of a number of private mineral leases of patented federal mining claims and 758 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor as well as a large water right.

Based upon a USD 1300 gold price and a silver to gold price ratio of 59:1, the North Bullfrog project currently has estimated mineral resources defined in six deposits: the structurally controlled Yellowjacket milling deposit and the oxidized disseminated heap leach Sierra Blanca, Jolly Jane, Air Track West, Connection and Mayflower deposits.

The Yellowjacket vein-style milling deposit has an Indicated Mineral Resource of 3.69 Mt at an average grade of 1.03 g/t gold and 5.52 g/t silver for 122,000 contained ounces of gold and 654,000 ounces of silver and an Inferred Mineral Resource of 18.40 Mt with an average grade of 0.94 g/t gold and 6.16 g/t silver for 555,000 contained ounces of gold and 3.64M ounces of silver, both at a 0.29 g/t gold cutoff.

The five oxidized disseminated heap leach deposits contain an Indicated Mineral Resource of 25.72 Mt at an average grade of 0.29 g/t gold for 240,000 contained ounces of gold and an Inferred Mineral Resource of 185.99 Mt at 0.19 g/t gold for 1,136,000 contained ounces of gold (both at a 0.13 g/t gold cut-off), with appreciable silver credits.

For full details with respect to the assumptions underlying the current resource estimate detailed herein, please review the Company’s latest NI 43-101 technical report entitled “Technical Report - The North Bullfrog Project, Bullfrog Mining District, Nye County, Nevada” dated April 1, 2014 and available on SEDAR or at the Company’s website www.corvusgold.com.

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options.

Carl E. Brechtel, (Nevada PE 008744 and Registered Member 353000 of SME), a qualified person as defined by National Instrument 43-101, has supervised execution of the work outlined in this news release and has approved the disclosure herein. Mr. Brechtel is not independent of Corvus, as he is the COO and holds common shares and incentive stock options.

The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, and Mark Reischman, Corvus Nevada Exploration Manager, who are responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Minerals in Reno, Nevada, for preparation and then on to ALS Minerals in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Minerals’s quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control.

About Corvus Gold Inc.

Corvus Gold Inc. is a North American gold exploration company, which is focused on advancing its 100% controlled Nevada, North Bullfrog project towards a potential development decision. In addition, the Company controls a number of other North American exploration properties representing a spectrum of gold, silver and copper projects.

On behalf of

Corvus Gold Inc.

(signed) Jeffrey A. Pontius

Jeffrey A. Pontius,

Chief Executive Officer

Contact Information: Ryan Ko

Investor Relations

Email: info@corvusgold.com

Phone: 1-888-770-7488 (toll free) or (604) 638-3246 /Fax: (604) 408-7499

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the anticipated content, commencement and cost of exploration programs, anticipated exploration program results, the discovery and delineation of mineral deposits/resources/reserves, the potential to develop multiple Yellowjacket style high-grade zones, the Company’s belief that the parameters used in the Whittle® pit optimization process are realistic and reasonable, the potential to discover additional high grade veins or additional deposits, the potential to expand the existing estimated resource at the North Bullfrog Project, the potential for any mining or production at North Bullfrog, the potential for the Company to secure or receive any royalties in the future, business and financing plans and business trends, are forward-looking statements. Information concerning mineral resource estimates may be deemed to be forward-looking statements in that it reflects a prediction of the mineralization that would be encountered if a mineral deposit were developed and mined. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company may produce or plan to produce, the Company's inability to obtain any necessary permits, consents or authorizations required for its activities, the Company's inability to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, and other risks and uncertainties disclosed in the Company’s 2013 Annual Information Form and latest interim Management Discussion and Analysis filed with certain securities commissions in Canada. All of the Company’s Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company’s mineral properties.

Cautionary Note Regarding References to Resources and Reserves

National Instrument 43 101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this press release have been prepared in accordance with NI 43-101 and the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resource and Mineral Reserves, adopted by the CIM Council on November 14, 2004 (the “CIM Standards”) as they may be amended from time to time by the CIM.

United States shareholders are cautioned that the requirements and terminology of NI 43-101 and the CIM Standards differ significantly from the requirements and terminology of the SEC set forth in the SEC’s Industry Guide 7 (“SEC Industry Guide 7”). Accordingly, the Company’s disclosures regarding mineralization may not be comparable to similar information disclosed by companies subject to SEC Industry Guide 7. Without limiting the foregoing, while the terms “mineral resources”, “inferred mineral resources”, “indicated mineral resources” and “measured mineral resources” are recognized and required by NI 43-101 and the CIM Standards, they are not recognized by the SEC and are not permitted to be used in documents filed with the SEC by companies subject to SEC Industry Guide 7. Mineral resources which are not mineral reserves do not have demonstrated economic viability, and US investors are cautioned not to assume that all or any part of a mineral resource will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade without reference to unit amounts. The term “contained ounces” is not permitted under the rules of SEC Industry Guide 7. In addition, the NI 43-101 and CIM Standards definition of a “reserve” differs from the definition in SEC Industry Guide 7. In SEC Industry Guide 7, a mineral reserve is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made, and a “final” or “bankable” feasibility study is required to report reserves, the three-year historical price is used in any reserve or cash flow analysis of designated reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

This press release is not, and is not to be construed in any way as, an offer to buy or sell securities in the United States.