Corvus Gold Expands Higher Grade Mineralization 500 metres North of Sierra Blanca Deposit at North Bullfrog Project, Nevada

July 10, 2013

| Highlights: | NB-13-219 - 67 metres @ 0.52g/t Gold |

| NB-13-220 - 44 metres @ 0.62g/t Gold |

Vancouver, BC……..Corvus Gold Inc. (“Corvus” or the “Company”) - (TSX: KOR, OTCQX: CORVF) announces results from the first two resource expansion Reverse Circulation (RC) holes on the North Sierra Blanca “Starter Pit” target. Holes NB-13-219 and NB-13-220 were drilled as 200 metre step-outs to the west and southwest of the previous 2012 scout hole NB-12-119, outside of the currently defined Sierra Blanca Whittle pit. Both holes encountered broad zones of characteristic alteration related to the North Bullfrog gold system and returned broad zones of mineralization similar to the original scout hole NB-12-119 (Figure 1).

Both NB-13-219 (67m @ 0.52g/t gold) and NB-13-220 (44m @ 0.62g/t gold) show a normal stratigraphic section with the best grade mineralization developed in the middle Sierra Blanca Tuff unit which starts approximately 75 metres below surface to about 200 metres in depth. The 17m @ 1.05g/t gold intercept in NB-13-219 represents a structure that will be targeted with follow up core drilling for additional Yellow Jacket type high-grade mineralization. Also of interest is the presence of higher grade silver mineralization in the bottom of NB-13-220 (9.2m @ 10.09g/t silver). This could also reflect the presence of additional Yellow Jacket style mineralization in this area. Of importance, the grades of these holes are significantly higher than the average grade within the Sierra Blanca oxidized resource as outlined in the most recent PEA (NR-13-13, June 4, 2013).

A further 6 holes completed to date on approximately 100 metre centers have all shown encouraging zones of mineral system alteration over even broader intervals in what appear to be dome-like intrusive bodies.

In addition to the drill results, the Company reports that in June formal meetings were held with officials of both the Nevada Department of Environmental Protection and the Bureau of Land Management to discuss the design criteria for the environmental baseline studies that will be required to support the development of a Plan Of Operation and other permit applications for the North Bullfrog mining project.

Jeff Pontius, Chief Executive Officer, states: “The results of the recent follow up holes in the North Sierra Blanca Starter Pit target are very encouraging and indicate significant potential to delineate a large higher grade deposit. The close association of the mineral system in this area with intrusive dome features is highly encouraging as it suggests we could be getting into the center of the system with not only potential for large bulk tonnage zones of higher grades but potential for additional high-grade systems like Yellow Jacket. The early results for the 2013 drill program at North Bullfrog have dramatically enhanced the project as a major new Nevada gold discovery.”

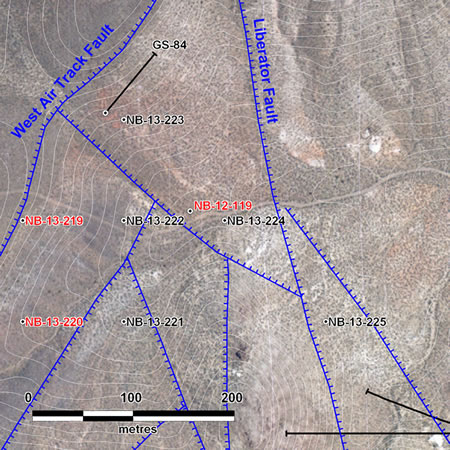

Figure 1: Location of new reverse circulation at North Sierra Blanca. Red labels indicate assays reported in Table 1. Black labels are holes that have been drilled but have assays pending.

North Sierra Blanca “Starter Pit” target

In 2012 hole NB-12-119 was drilled to evaluate the continuity of the North Bullfrog mineral system to the north of Sierra Blanca Ridge. This hole represented a 350 metre step out from the nearest known mineralization. Results from this hole where extremely encouraging with over 50 metres of mineralization with grades in excess of 0.5g/t gold (Table 1).

The objective of the 2013 drill program at North Sierra Blanca is to map the distribution of this higher grade, disseminated mineralization to define a higher grade Starter pit area of the deposit and set the stage for follow up core drilling to look for high-grade Yellow Jacket type structural zones. The 100 metre grid spacing will provide information on the stratigraphy to aid the interpretation of the geophysics data so potential high-grade structures can be more accurately identified for drill testing.

Table 1: Significant intercepts* from North Sierra Blanca RC holes.

|

HoleID |

From (m) |

To (m) |

Interval (m) |

Gold (g/t) |

Silver (g/t) |

Comments |

|

NB-12-119 |

97.5 |

128.0 |

30.5 |

0.32 |

1.05 |

|

|

|

134.1 |

150.9 |

16.8 |

0.58 |

2.58 |

|

|

|

158.5 |

182.9 |

24.4 |

0.59 |

2.13 |

Ended in Mineralization |

|

Including |

166.1 |

182.9 |

16.8 |

0.70 |

2.61 |

Ended in Mineralization |

|

NB-13-219 |

109.7 |

176.8 |

67.0 |

0.52 |

1.14 |

|

|

Including |

141.7 |

158.5 |

16.8 |

1.05 |

2.22 |

|

|

NB-13-220 |

71.6 |

198.1 |

126.5 |

0.37 |

1.97 |

|

|

Including |

77.7 |

121.9 |

44.2 |

0.62 |

1.52 |

|

|

Including |

187.4 |

196.6 |

9.2 |

0.21 |

10.09 |

High Silver |

*Intercepts calculated with 0.1g/t cutoff and up to 3m internal waste. Assuming that the mineralization is roughly stratiform in character the intercepts are approximately true thickness.

Figure 2: The North Sierra Blanca target is the area located north of the Sierra Blanca resource as reflected by the Whittle Pit outline. Holes NB-12-118 and NB-12-119 were step out holes that highlighted the potential of this area.

About the North Bullfrog Project, Nevada

Corvus controls 100% of its North Bullfrog Project, which covers approximately 70 km² in southern Nevada just north of the historic Bullfrog gold mine formerly operated by Barrick Gold Corporation. The property package is made up of a number of leased patented federal mining claims and 758 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor. The Company’s independent consultants completed a robust positive Preliminary Economic Assessment on the existing resource in December 2012.

The project currently includes numerous prospective gold targets with four (Mayflower, Sierra Blanca, Jolly Jane and Connection) containing an estimated Indicated Resource of 15 Mt at an average grade of 0.37 g/t gold for 182,577 ounces of gold and an Inferred Resource of 156 Mt at 0.28 g/t gold for 1,410,096 ounces of gold (both at a 0.2 g/t cutoff), with appreciable silver credits. Mineralization occurs in two primary forms: (1) broad stratabound bulk-tonnage gold zones such as the Sierra Blanca and Jolly Jane systems; and (2) moderately thick zones of high-grade gold and silver mineralization hosted in structural feeder zones with breccias and quartz-sulphide vein stockworks such as the Mayflower and Yellowjacket targets. The Company is actively pursuing both types of mineralization.

A video of the North Bullfrog project showing location, infrastructure access and 2010 winter drilling is available on the Company’s website at http://www.corvusgold.com/investors/video/. For details with respect to the assumptions underlying the current resource estimate and preliminary economic analysis, see the technical report entitled “Technical Report and Preliminary Economic Assessment for the Mayflower and North Mine Areas at the North Bullfrog Project, Bullfrog Mining District, Nye County, Nevada” dated December 6, 2012 and available under the Company’s profile at www.sedar.com.

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information (other than the resource estimate) that form the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options.

Mr. Gary Giroux, M.Sc., P. Eng (B.C.), a consulting geological engineer employed by Giroux Consultants Ltd., has acted as the Qualified Person, as defined in NI 43-101, for the Giroux Consultants Ltd. mineral resource estimate. He has over 30 years of experience in all stages of mineral exploration, development and production. Mr. Giroux specializes in computer applications in ore reserve estimation, and has consulted both nationally and internationally in this field. He has authored many papers on geostatistics and ore reserve estimation and has practiced as a Geological Engineer since 1970 and provided geostatistical services to the industry since 1976. Both Mr. Giroux and Giroux Consultants Ltd. are independent of the Company under NI 43-101.

The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, and Mark Reischman, Corvus Nevada Exploration Manager, who are responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Chemex’s quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control. McClelland Laboratories Inc. prepared composites from duplicated RC sample splits collected during drilling. Bulk samples were sealed on site and delivered to McClelland Laboratories Inc. by ALS Chemex or Corvus personnel. All metallurgical testing reported here was conducted or managed by McClelland Laboratories Inc.

About Corvus Gold Inc.

Corvus Gold Inc. is a resource exploration company, focused in Nevada, Alaska and Quebec, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is focused on advancing its 100% owned Nevada, North Bullfrog project towards a potential development decision and continuing to explore for new major gold discoveries. Corvus is committed to building shareholder value through new discoveries and leveraging noncore assets via partner funded exploration work into carried and or royalty interests that provide shareholders with exposure to gold production.

On behalf of

Corvus Gold Inc.

(signed) Jeffrey A. Pontius

Jeffrey A. Pontius,

Chairman and Chief Executive Officer

Contact Information: Ryan Ko

Investor Relations

Email: info@corvusgold.com

Phone: 1-888-770-7488 (toll free) or (604) 638-3246 / Fax: (604) 408-7499

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the anticipated content, commencement and cost of exploration programs, anticipated exploration program results, the discovery and delineation of mineral deposits/resources/reserves, the potential for any mining or production at North Bullfrog, the potential for the identification of multiple deposits at North Bullfrog, the potential for a low-cost run-of-mine heap leach operation at North Bullfrog, the potential for there to be a low strip ratio in connection with any mine at North Bullfrog, the potential for the existence or location of additional high-grade veins, the proposed completion of a PEA for the North Bullfrog project, the potential for additional resources to be located between certain of the existing deposits, the potential for the Company to secure or receive any royalties in the future, business and financing plans and business trends, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company may produce or plan to produce, the Company's inability to obtain any necessary permits, consents or authorizations required for its activities, the Company's inability to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, and other risks and uncertainties disclosed in the Company’s latest interim Management Discussion and Analysis and filed with certain securities commissions in Canada. All of the Company’s Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company’s mineral properties.

Cautionary Note Regarding References to Resources and Reserves

National Instrument 43 101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this press release have been prepared in accordance with NI 43-101 and the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resource and Mineral Reserves, adopted by the CIM Council on November 14, 2004 (the “CIM Standards”) as they may be amended from time to time by the CIM.

United States shareholders are cautioned that the requirements and terminology of NI 43-101 and the CIM Standards differ significantly from the requirements and terminology of the SEC set forth in the SEC’s Industry Guide 7 (“SEC Industry Guide 7”). Accordingly, the Company’s disclosures regarding mineralization may not be comparable to similar information disclosed by companies subject to SEC Industry Guide 7. Without limiting the foregoing, while the terms “mineral resources”, “inferred mineral resources”, “indicated mineral resources” and “measured mineral resources” are recognized and required by NI 43-101 and the CIM Standards, they are not recognized by the SEC and are not permitted to be used in documents filed with the SEC by companies subject to SEC Industry Guide 7. Mineral resources which are not mineral reserves do not have demonstrated economic viability, and US investors are cautioned not to assume that all or any part of a mineral resource will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade without reference to unit amounts. The term “contained ounces” is not permitted under the rules of SEC Industry Guide 7. In addition, the NI 43-101 and CIM Standards definition of a “reserve” differs from the definition in SEC Industry Guide 7. In SEC Industry Guide 7, a mineral reserve is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made, and a “final” or “bankable” feasibility study is required to report reserves, the three-year historical price is used in any reserve or cash flow analysis of designated reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

Caution Regarding Adjacent or Similar Mineral Properties

This news release contains information with respect to adjacent or similar mineral properties in respect of which the Company has no interest or rights to explore or mine. The Company advises US investors that the mining guidelines of the US Securities and Exchange Commission (the “SEC”) set forth in the SEC’s Industry Guide 7 (“SEC Industry Guide 7”) strictly prohibit information of this type in documents filed with the SEC. Readers are cautioned that the Company has no interest in or right to acquire any interest in any such properties, and that mineral deposits on adjacent or similar properties are not indicative of mineral deposits on the Company’s properties.

This press release is not, and is not to be construed in any way as, an offer to buy or sell securities in the United States.