Corvus Gold Extends High-Grade Veins North & South and Discovers New Vein, Yellowjacket Deposit, North Bullfrog Project, Nevada

May 22, 2014

| NB-14-391 | Josh Vein: 17.5 metres @ 12.8 g/t Gold and 62 g/t Silver | ||

| NB-14-389 | West Vein: 9 metres @ 5.7 g/t Gold and 33 g/t Silver |

Vancouver, B.C… Corvus Gold Inc. (“Corvus” or the “Company”) - (TSX: KOR, OTCQX: CORVF) announces the latest results from its ongoing 2014 Phase One drill campaign at the North Bullfrog Project in Nevada. Assays include the complete results of the previously reported hole NB-14-384 as well as three recently completed holes from the newly discovered West Vein zone. In addition, hole NB-14-391, which is the first hole drilled in 2014 on the Northern extension of the main Josh Vein, intersected 17.5 metres of 12.77 g/t gold and 62 g/t silver (Figure 1, Table 1). This hole is a 30 metre step out to the North from the farthest northern holes drilled in 2013 and returned the best intersection drilled to date. It is important to note that results from Hole NB-391 represent only the main vein interval, and assays from the surrounding stockwork and disseminated zones are still pending.

In the West Vein structure, hole NB-14-384 intersected 4.5 metres of 17 g/t gold and 150 g/t silver, 50 metres south of NB-14-380 (5 metres at 14 g/t gold), while hole NB-14-389, 30 metres south of NB-13-384, encountered 9.1 metres of 5.7 g/t gold and 33 g/t silver. The stockwork around the West Vein continues to return broad zones of gold and silver mineralization extending as far south as drilling has progressed to date (Table 1).

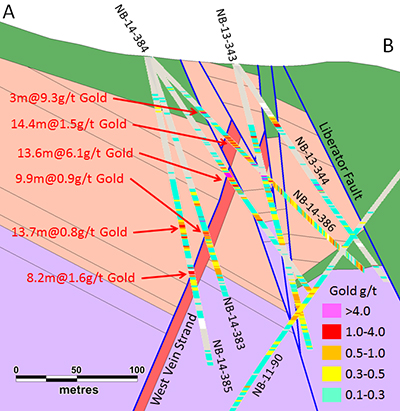

Drilling has now shown that, south of NB-14-389, the fault strands merge into a zone of intense faulting resulting in widespread vein related mineralization (Figure 2). Of particular interest is the structure near the top of NB-14-386 which contained 3.2 metres with 9.2 g/t gold and 87 g/t silver and represents a newly discovered vein structure (Figure 2). In NB-14-386, results indicate almost 100 metres of stockwork developed in this large fault zone (Table 1, Figure 2). Assays are pending for two holes drilled down dip of the structure in NB-12-184, which is currently the furthest drilling to the south on the Yellowjacket system (Figure 1).

Exploration on the northern extension of the Josh Vein began in late April and the first four holes, including NB-14-391 (17.5 metres @ 12.77 g/t gold and 62 g/t silver), have established the continuity of the zone to the north with the presence of native gold and silver sulphide (acanthite) in thick quartz veins and surrounding stockwork veining. The north extension drill program is ongoing, and is initially assessing a 200 metre expansion of the system. Following the initial north program, drilling will move south to assess the southern extension potential below hole NB-12-184.

Yellowjacket Vein Zone Exploration

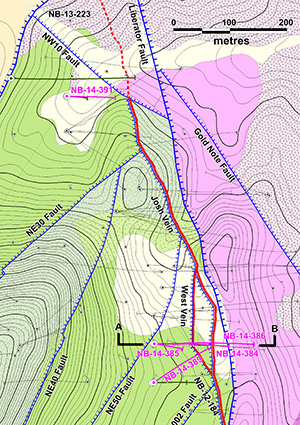

The Yellowjacket Vein Zone at North Bullfrog is currently defined by the Josh-West Vein structural zone on the west and the Liberator Fault to the east (Figure 1). The interaction of these two faults has created a large broken zone which contains several quartz veined structures, such as the Josh Vein, and broad zones of stockwork mineralization (Figure 2). The West Vein strand delineated by 2014 drilling represents a new hangingwall splay off the main Josh Vein Fault, as well as the new vein structure intercepts in NB-14-386 reported in this news release. Ongoing drilling is continuing to intersect new vein structures within and around the overall Yellowjacket deposit.

Drilling now indicates that large northeast faults such as the NE30 and NE50 faults (Figure 1) do not cut off the Josh Vein Fault system but enhance it as a host for vein development and have emerged as new exploration targets. The stratigraphic reconstruction in Figure 2 indicates that Yellowjacket has undergone a complex fault history resulting in multiple zones.

The 5,000 metre Phase One drilling program at North Bullfrog will continue to focus on delineating the Yellowjacket system. In the planned 15,000 metre Phase Two program, additional core rigs will be added to conduct resource definition drilling and continue with the District-wide exploration for other vein systems.

Table 1: Significant Intercepts* from 2014 Drilling at Yellowjacket

(Reported drill intercepts are not true widths. At this time, there is insufficient data with respect to the shape of the mineralization to calculate its true orientation in space.)

| Hole ID | From (m) | To (m) | Interval (m) | Gold (g/t) | Silver (g/t) | Comments |

|

|

||||||

| 124.4 | 129.1 | 4.7 | 0.55 | 2.24 | ||

| 138.1 | 150.3 | 12.2 | 0.52 | 1.55 | WV HW Periph | |

| 150.3 | 160.1 | 9.9 | 0.86 | 7.97 | WV HW Stockwork | |

| NB-14-383 | 160.1 | 164.9 | 4.7 | 0.40 | 3.98 | West Vein |

| 164.9 | 192.5 | 27.6 | 0.43 | 1.61 | WV FW Stockwork | |

| Az 90; Incl -80 | 42.2 | 0.52 | 3.36 | West Vein + Stockwork | ||

|

|

||||||

| 103.5 | 114.4 | 10.9 | 0.58 | 5.57 | WV HW Stockwork | |

| NB-14-384 | 114.4 | 128.0 | 13.6 | 6.13 | 83 | West Vein |

| Including | 114.4 | 118.9 | 4.5 | 16.70 | 150 | |

| 128.0 | 134.8 | 6.8 | 0.37 | 1.26 | WV FW Stockwork | |

| 31.3 | 2.95 | 0.85 | West Vein + Stockwork | |||

| Az 90 Incl -55 | 152.3 | 165.5 | 13.2 | 0.58 | 1.12 | FW Veining |

| 224.8 | 234.1 | 9.3 | 0.46 | 0.76 | Ended in Min | |

|

|

||||||

| 133.5 | 162.3 | 28.8 | 0.59 | 2.62 | WV upper Stkwk | |

| 175.7 | 177.7 | 2.0 | 0.61 | 2.27 | WV HW Stkwk | |

| NB-14-385 | 177.7 | 183.4 | 5.7 | 2.10 | 2.88 | West Vein |

| 183.4 | 195.6 | 12.2 | 0.35 | 4.28 | WV FW Stkwk | |

| Az 90 Incl -78 | 19.9 | 0.88 | 3.68 | West Vein + Stockwork | ||

|

|

||||||

| 61.0 | 64.2 | 3.2 | 9.43 | 87 | New vein | |

| NB-14-386 | 89.5 | 103.9 | 14.4 | 1.53 | 10 | West Vein |

| Including | 92.2 | 95.7 | 3.5 | 2.86 | 28 | |

| 103.9 | 123.3 | 19.4 | 1.49 | 4.03 | WV FWStkwk | |

| 33.8 | 1.51 | 6.64 | West Vein + Stockwork | |||

| Az 90 Incl -45 | 130.9 | 173.1 | 42.3 | 0.65 | 3.04 | Lib FW Stockwork |

| 176.7 | 220.6 | 44.0 | 0.48 | 1.47 | Lib FW Stockwork | |

| 237.7 | 246.0 | 8.3 | 0.74 | 2.38 | Lib FW Stockwork | |

|

|

||||||

| 142.0 | 152.6 | 10.6 | 1.08 | 2.84 | WV HW Stockwork | |

| NB-14-389 | 152.6 | 161.7 | 9.1 | 5.66 | 33 | West Vein |

| 161.7 | 166.6 | 4.9 | 1.04 | 1.79 | WV FW Stockwork | |

| Az 58 Incl -57 | 24.6 | 2.75 | 13.72 | West Vein + Stockwork | ||

|

|

||||||

| NB-14-391 | 133.4 | 144.4 | 17.5 | 12.77 | 62 | Josh Vein |

| Including | 135.4 | 139.3 | 3.8 | 20.06 | 105 | |

| Including | 142.6 | 144.4 | 8.4 | 17.16 | 70 | |

| Az 90 Incl -67 | ||||||

|

|

||||||

*The veining and stockwork veining have been defined by geological observation of the percentage of veining in the interval, e.g. significant concentrations of veining in the immediate hangingwall and footwall of a significant vein. Outside of the immediate hangingwall and footwall zones a cutoff of 0.3g/t gold equivalent has been used assuming a 59:1 price ratio of gold to silver. Up to 3 metres of internal waste has been carried locally.

Figure 1: Location of 2014 drill holes at Yellowjacket. Assays from the holes indicated in fuscia are reported in this release. Green traces are from holes with pending assays. The location of the section in Figure 2 is indicated.

Figure 2: Geological Cross Section through holes NB-14-383, 384, 385 and 386 reported here.

Stratigraphic markers used in the interpretation are indicated by thin black lines

Preliminary Economic Assessment Update

In addition to its ongoing Yellowjacket deposit resource expansion drill program, Corvus continues to advance its mine development studies, including mining, metallurgy, capital estimates and environmental characterization. This ongoing work will be used for a planned updated resource estimate and new Preliminary Economic Assessment following the completion of the 2014 drill program.

About the North Bullfrog Project, Nevada

Corvus controls 100% of its North Bullfrog Project, which covers approximately 68 km² in southern Nevada. The property package is made up of a number of private mineral leases of patented federal mining claims and 758 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor as well as a large water right.

Based upon a USD 1300 gold price and a silver to gold price ratio of 59:1, the North Bullfrog Project currently has estimated mineral resources defined in six deposits: the structurally controlled Yellowjacket milling deposit and the oxidized disseminated heap leach Sierra Blanca, Jolly Jane, Air Track West, Connection and Mayflower deposits. The Yellowjacket vein-style deposit has an Indicated Mineral Resource of 3.69 Mt at an average grade of 1.03 g/t gold and 5.52 g/t silver for 122,000 contained ounces of gold and 654,000 ounces of silver and an Inferred Mineral Resource of 18.40 Mt with an average grade of 0.94 g/t gold and 6.16 g/t silver for 555,000 contained ounces of gold and 3.64M ounces of silver, both at a 0.29 g/t gold cutoff.

The five oxidized disseminated heap leach deposits contain an Indicated Mineral Resource of 25.72 Mt at an average grade of 0.29 g/t gold for 240,000 contained ounces of gold and an Inferred Mineral Resource of 185.99 Mt at 0.19 g/t gold for 1,136,000 contained ounces of gold (both at a 0.13 g/t gold cut-off), with appreciable silver credits.

For full details with respect to the assumptions underlying the current resource estimate detailed herein, please review the Company’s latest NI 43-101 technical report entitled “Technical Report - The North Bullfrog Project, Bullfrog Mining District, Nye County, Nevada” dated April 1, 2014 and available on SEDAR or at the Company’s website www.corvusgold.com.

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options.

Carl E. Brechtel, (Nevada PE 008744 and Registered Member 353000 of SME), a qualified person as defined by National Instrument 43-101, has supervised execution of the work outlined in this news release and has approved the disclosure herein. Mr. Brechtel is not independent of Corvus, as he is the COO and holds common shares and incentive stock options.

The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, and Mark Reischman, Corvus Nevada Exploration Manager, who are responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Minerals in Reno, Nevada, for preparation and then on to ALS Minerals in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Minerals’s quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control.

About Corvus Gold Inc.

Corvus Gold Inc. is a North American gold exploration company, which is focused on advancing its 100% controlled Nevada, North Bullfrog Project towards a potential development decision. In addition, the Company controls a number of other North American exploration properties representing a spectrum of gold, silver and copper projects.

On behalf of

Corvus Gold Inc.

(signed) Jeffrey A. Pontius

Jeffrey A. Pontius,

Chief Executive Officer

Contact Information: Ryan Ko

Investor Relations

Email: info@corvusgold.com

Phone: 1-888-770-7488 (toll free) or (604) 638-3246 /Fax: (604) 408-7499

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the anticipated content, commencement and cost of exploration programs, including completing the Phase One drilling program and commencement of the Phase Two drilling program, anticipated exploration program results, including timing and results of future assays, the discovery and delineation of mineral deposits/resources/reserves, the potential to develop multiple Yellowjacket style high-grade zones, the potential to discover additional high grade veins or additional deposits, the potential to expand the existing estimated resource at the North Bullfrog project, including the timing and completion of the proposed resource update and new PEA, the potential for any mining or production at North Bullfrog, business and financing plans and business trends, are forward-looking statements. Information concerning mineral resource estimates may be deemed to be forward-looking statements in that it reflects a prediction of the mineralization that would be encountered if a mineral deposit were developed and mined. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company may produce or plan to produce, the Company’s inability to obtain any necessary permits, consents or authorizations required for its activities, the Company’s inability to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, and other risks and uncertainties disclosed in the Company’s 2013 Annual Information Form and latest interim Management Discussion and Analysis filed with certain securities commissions in Canada. All of the Company’s Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company’s mineral properties.

Cautionary Note Regarding References to Resources and Reserves

National Instrument 43 101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this press release have been prepared in accordance with NI 43-101 and the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resource and Mineral Reserves, adopted by the CIM Council on November 14, 2004 (the “CIM Standards”) as they may be amended from time to time by the CIM.

United States shareholders are cautioned that the requirements and terminology of NI 43-101 and the CIM Standards differ significantly from the requirements and terminology of the SEC set forth in the SEC’s Industry Guide 7 (“SEC Industry Guide 7”). Accordingly, the Company’s disclosures regarding mineralization may not be comparable to similar information disclosed by companies subject to SEC Industry Guide 7. Without limiting the foregoing, while the terms “mineral resources”, “inferred mineral resources”, “indicated mineral resources” and “measured mineral resources” are recognized and required by NI 43-101 and the CIM Standards, they are not recognized by the SEC and are not permitted to be used in documents filed with the SEC by companies subject to SEC Industry Guide 7. Mineral resources which are not mineral reserves do not have demonstrated economic viability, and US investors are cautioned not to assume that all or any part of a mineral resource will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade without reference to unit amounts. The term “contained ounces” is not permitted under the rules of SEC Industry Guide 7. In addition, the NI 43-101 and CIM Standards definition of a “reserve” differs from the definition in SEC Industry Guide 7. In SEC Industry Guide 7, a mineral reserve is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made, and a “final” or “bankable” feasibility study is required to report reserves, the three-year historical price is used in any reserve or cash flow analysis of designated reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

This press release is not, and is not to be construed in any way as, an offer to buy or sell securities in the United States.